Judge Michael B. Kaplan has approved the chapter 11 bankruptcy for J&J subunit LTL Management, a decision which will shield the pharmaceutical and consumer giant from tens of thousands of talc product lawsuits, according to Law360.

In a 56-page opinion, Judge Kaplan described what he believed was “a strong conviction that the bankruptcy court is the optimal venue for redressing the harms of both present and future talc claimants in this case — ensuring a meaningful, timely, and equitable recovery.” In this opinion, Judge Kaplan rejected the claims of the plaintiffs and instead found that the bankruptcy should proceed.

For months, talc plaintiffs have argued that J&J created a new entity, LTL Management, solely for the purpose of sheltering its liabilities and then forcing that entity into bankruptcy. Plaintiffs say this is a transparent attempt to shut down talc claims and prevent future claims.

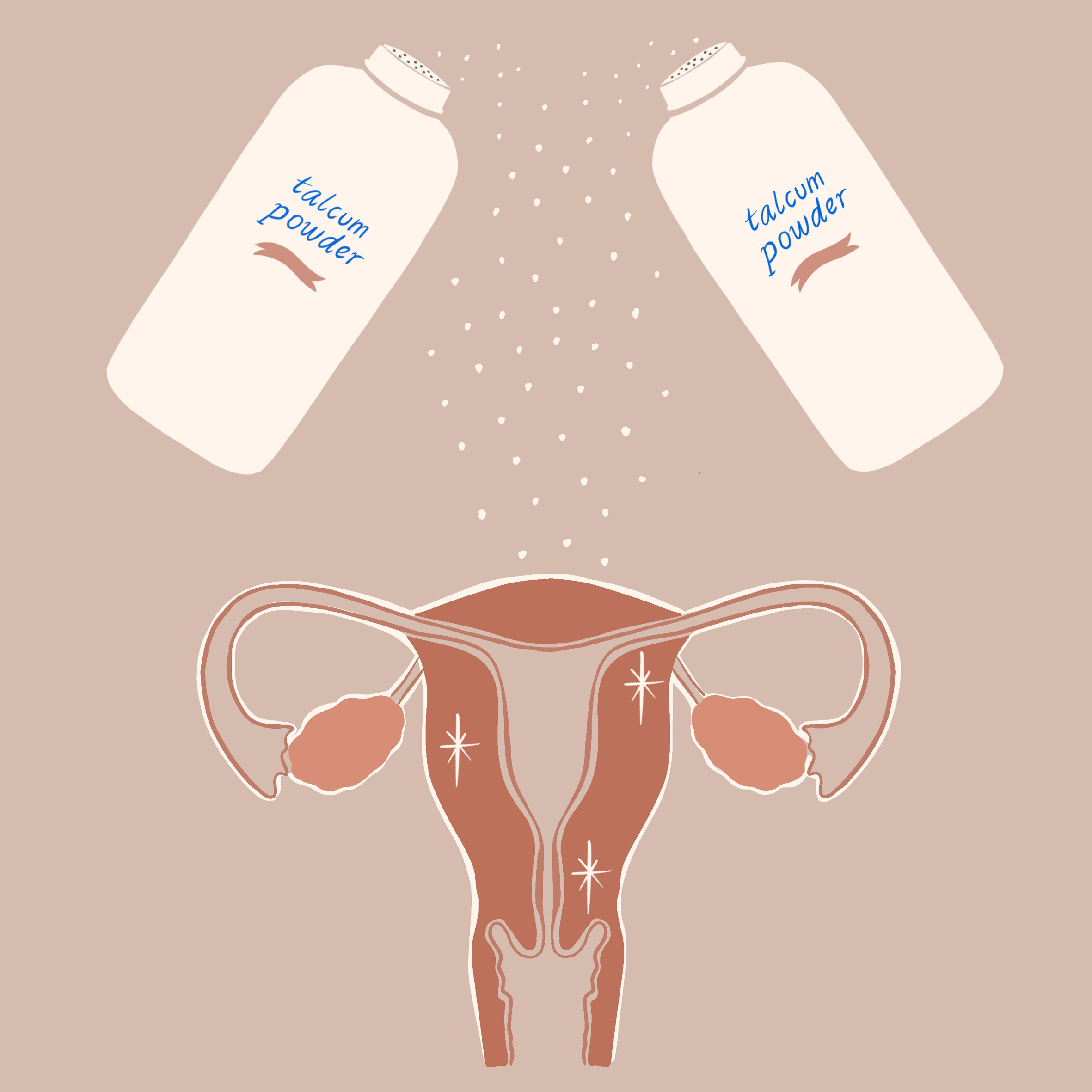

Johnson & Johnson faces more than 30,000 claims from consumers who used J&J talcum powder products and developed ovarian cancer that they claim is the result of asbestos contamination.

Judge Kaplan does not directly engage with the notion of whether J&J is using this bankruptcy procedure to shield the parent company from liability. Instead, Judge Kaplan states, “the tort system produces an uneven, slow-paced race to the courthouse, with winners and losers."

Instead of pursuing litigation in the MDL, Judge Kaplan argues that "[p]resent and future talc claimants should not have to bear the sluggish pace and substantial risk if there exists another viable option” in the form of a bankruptcy settlement.

With regards to compensation, Judge Kaplan has ruled that the $61 billion housed in LTL Management to fund the creation of a trust is adequate for all current and future claimants. This ruling is not based on the per-patient recovery amount but rather that the amount is equal to the value of Johnson & Johnson Consumer Inc., the subsidiary of the main company that was restructured to create LTL Management.

The plaintiffs have resolved to attempt further avenues to appeal this decision, arguing that although Johnson & Johnson Consumer Inc. may have been valued at $61 billion, it is not sufficient to fund the needs of the plaintiffs allegedly harmed by Johnson & Johnson. By accepting these proceedings, plaintiffs would be forced to accept that there will no longer be any way to make J&J pay for their alleged actions.