On May 10, the states of New Mexico and Mississippi, along with cancer victims and the U.S. Department of Justice, took action to dismiss the latest bankruptcy petition by LTL, the subunit of Johnson & Johnson (J&J) that was created to hold J&J’s talc litigation liabilities.

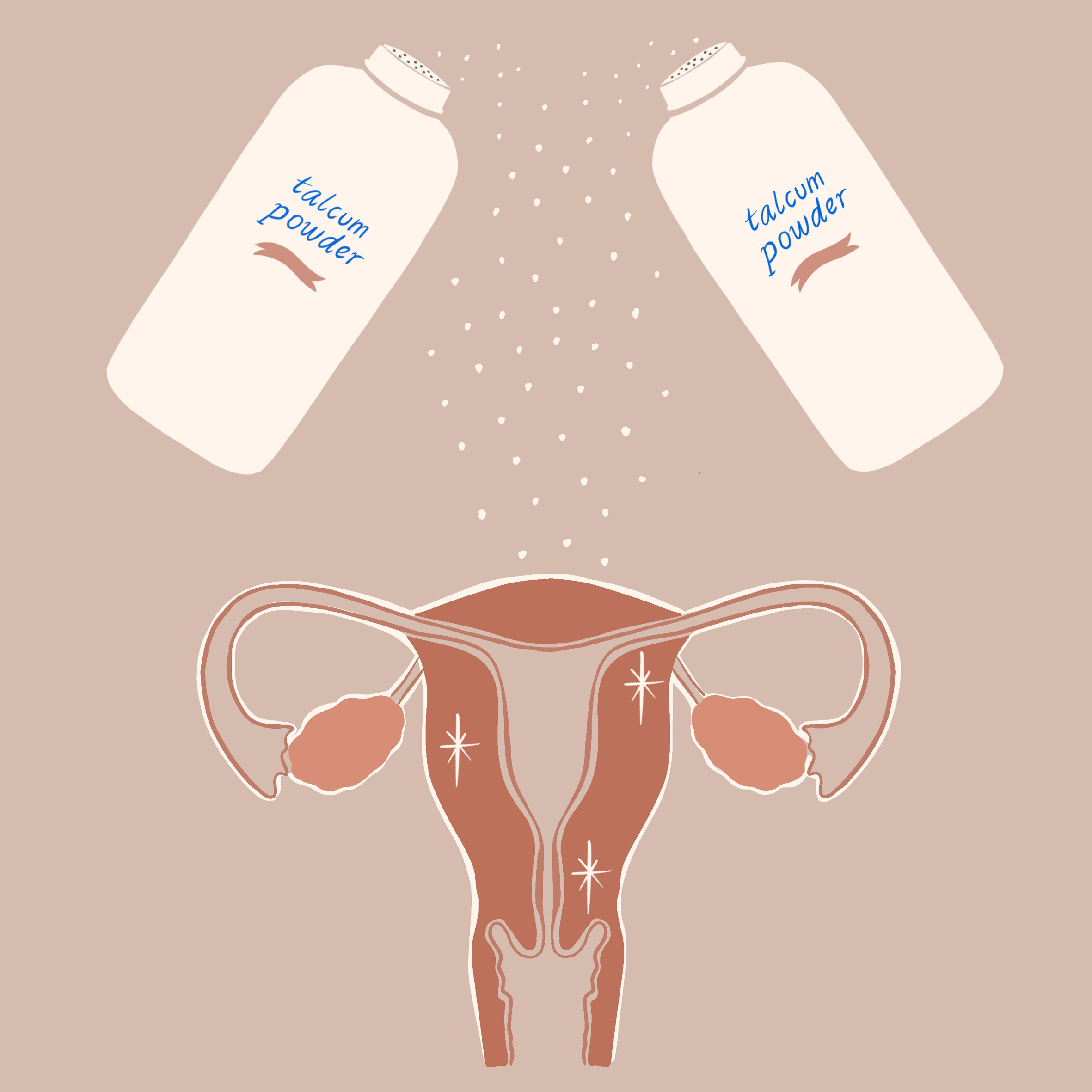

J&J recently offered nearly $9 billion to settle tens of thousands of lawsuits and future claims that its talc-containing products, including the brand’s iconic and discontinued J&J talc baby powder, were contaminated with asbestos, a chemical and known carcinogen. To settle these claims, LTL Management’s second bankruptcy petition would need approval.

Under J&J’s $8.9 billion settlement plan, $400 million would be allocated for consumer protection (“deceptive marketing”) lawsuits, and the highest individual payments would be $500,000 for individuals diagnosed with terminal mesothelioma before the age of 45, and $260,000 for those diagnosed with terminal ovarian cancer before the age of 45. For other class members, compensation would begin at approximately $20,000, far less than the cost of medical treatment for ovarian cancer, per annum.

J&J faces more than 38,000 talcum powder ovarian cancer and mesothelioma lawsuits. These cancers can take a long time to develop, meaning that J&J could face thousands of more cases if a settlement is not approved.

In October 2021, J&J launched a controversial bankruptcy strategy called the "Texas two-step," which is criticized for exploiting the original intent of the bankruptcy system. In this case, J&J created a new entity, LTL Management, and offloaded its talc liabilities, including legal fees, settlements and trial verdicts onto the subunit. Days after its incorporation, LTL Management filed for Chapter 11 bankruptcy protection.

The bankruptcy protection, should it be approved, does not mean that talc claimants cannot receive compensation from LTL Management. But if the claimants receive any compensation, it would top the value of LTL’s assets. By holding millions of dollars in liabilities, the value of LTL would be minuscule compared to J&J’s $400 billion in market capitalization.

In its first settlement offering, tied to the LTL bankruptcy, J&J offered a $2 billion settlement offer. Earlier this year, the Third Circuit Court of Appeals rejected the bankruptcy plan, which is ostensibly why J&J upped its settlement offer and had LTL refile for bankruptcy in April.

In 2021, Mississippi and New Mexico filed failure to warn lawsuits against J&J over failing to warn consumers about the potential link between talcum powder and ovarian cancer. Attorneys general from Arizona, North Carolina, Texas, and Washington have also issued civil investigative demands, while the Maryland attorney general issued an administrative subpoena for consumer protection.

Currently, talc powder litigation is paused until at least mid-June while the new settlement offer is considered. Critics of the settlement maintain that $9 billion is insufficient to compensate ovarian cancer and mesothelioma sufferers for their injuries.

Contact MedTruth.com for a free case review.